17 Essential Steps of Export Procedure: A Beginner’s Roadmap to Global Trade

Expanding your business beyond domestic borders is a landmark achievement for any Indian entrepreneur. However, the transition from local seller to international exporter involves a series of regulatory and logistical milestones. Understanding the steps of export procedure is not just about moving goods; it is about compliance, financial security, and building a global reputation.

In this comprehensive roadmap, we break down the export process for beginners into 17 manageable steps, ensuring you have a clear logistics workflow from the moment you register your company to the day you receive payment in foreign currency.

Phase 1: Setting the Foundation (The Registration Stage)

Before you can ship a single carton, you must establish your legal identity as an exporter in India. This phase focuses on the essential export documentation required by the government.

1. Establishing the Organization

The first step is to decide on your business structure. Whether it is a Sole Proprietorship, Partnership Firm, or a Private Limited Company, your entity must be legally registered. This ensures that your business can enter into international contracts.

2. Opening a Bank Account

Exporting involves foreign exchange. You must open a Current Account with a bank authorized by the Reserve Bank of India (RBI) to deal in Foreign Exchange. This account will be linked to your business for all international transactions and government incentives.

3. Obtaining a PAN (Permanent Account Number)

Every exporter must have a PAN card issued by the Income Tax Department. For firms and companies, the PAN is issued in the name of the entity itself. This is the primary identification for all tax-related procedures in the export procedure in India.

4. Obtaining the IEC (Importer-Exporter Code)

The IEC is your “passport” for international trade. It is a 10-digit code issued by the Directorate General of Foreign Trade (DGFT). Without this code, you cannot clear customs or move goods across the Indian border.

Samruddhii Tip: Obtaining an IEC is now a completely online process. Ensure your business details match your bank records perfectly to avoid delays.

5. RCMC (Registration-cum-Membership Certificate)

To avail of benefits under India’s Foreign Trade Policy, you must register with the relevant Export Promotion Council (EPC). For example, if you are exporting agricultural products, you would register with APEDA. An RCMC acts as proof that you are a legitimate exporter in a specific product category.

Phase 2: Finding Markets and Finalizing the Deal

Once your paperwork is ready, the focus shifts to finding a buyer and securing a profitable contract. This is the “Marketing & Negotiation” core of the export procedure step by step.

6. Selection of Product & Market

Success starts with research. You must identify a product that has high demand in a specific target country. For example, Indian spices are in high demand in the EU, while engineering goods might find a larger market in Southeast Asia.

- Pro Tip: Use tools like Trade Map or DGFT statistics to see which countries are importing your chosen product.

7. Finding Buyers and Lead Generation

You cannot export without a customer. Beginners can find buyers through:

- B2B Portals: (IndiaMART, Alibaba, Global Sources).

- Trade Fairs: Attending exhibitions organized by your Export Promotion Council.

- Indian Embassies: Contacting the commercial wing of Indian embassies in target countries for lists of verified importers.

8. Sampling and Quality Approval

International buyers rarely place a large order without seeing the product first. Sending samples is a critical part of the export process for beginners. Ensure your sample reflects the exact quality you can deliver in bulk.

- Note: Reasonable samples can be exported via courier without a complex shipping bill, but check the latest value limits.

9. Pricing and Costing (Selecting Incoterms)

Pricing for export is different from domestic sales. You must calculate your “Export Price” by including:

- Product cost + Packaging.

- Transport to the port.

- Logistics Workflow costs (CHA fees, freight).

- Incoterms: Will you sell FOB (Free on Board – you pay until the port) or CIF (Cost, Insurance, and Freight – you pay until the buyer’s port)?

10. Negotiation and Finalizing the Contract

Once the price is agreed upon, you must issue a Proforma Invoice (PI). This is a preliminary bill that acts as a draft contract. It should clearly state:

- Product specifications.

- Payment terms (e.g., 30% advance, 70% against documents).

- Delivery timelines.

- Mode of shipment (Sea or Air).

Why Phase 2 Matters for Your Business

For users on samruddhii, this section is crucial because Step 9 (Pricing) is where they need a freight forwarder’s help.

Expert Insight for Readers: “Calculating your export cost incorrectly can wipe out your profit. At Samruddhii, we provide instant freight quotes for FOB and CIF terms, helping you give accurate, competitive prices to your international buyers.”

Phase 3: Execution, Logistics & Customs Clearance

Now that you have a signed contract, it is time to prepare the goods and move them toward the border. This phase covers the physical logistics workflow and the mandatory export documentation required by Indian Customs.

11. Production and Procurement

Based on the specifications in your Proforma Invoice, you must manufacture or procure the goods. Ensure the lead time matches the “Date of Shipment” promised to your buyer. Delays here can lead to heavy penalties or order cancellations.

12. Packaging and Labeling

International shipping requires specialized packaging to withstand long sea or air journeys.

- Labeling: Must comply with the destination country’s laws (showing country of origin, net weight, ingredients, etc.).

- Palletization: Goods are often placed on pallets for easy handling by forklifts at the port.

13. Pre-Shipment Inspection

To ensure quality, many buyers require a certificate from a third-party inspection agency (like SGS or Intertek). Additionally, certain products in India require mandatory inspection by the Export Inspection Agency (EIA) or specialized bodies like APEDA or FSSAI.

14. Marine/Transit Insurance

Safety first! Before the goods leave your warehouse, you must secure a marine insurance policy to protect against transit risks like theft, damage, or loss at sea. This is a vital part of the export procedure in India to protect your financial interests.

15. Customs Clearance (The Technical Stage)

This is the most critical step. Your goods are moved to the port (like Nhava Sheva or Mundra), and your Customs House Agent (CHA) files the Shipping Bill through the ICEGATE portal.

- The “LEO”: Customs officers examine the cargo and documents. Once satisfied, they issue a “Let Export Order” (LEO), which officially allows the goods to leave the country.

Samruddhii Expertise: As a licensed CHA, we handle Step 15 with precision. From filing the Shipping Bill to obtaining the LEO, we ensure your cargo doesn’t face unnecessary “holds” or “demurrage” charges at the port.

Phase 4: Post-Shipment Documentation & Payment

The goods are on the ship, but your job isn’t done until the money is in your bank account. This final stage of the export procedure step by step focuses on the “Title” of the goods and the realization of foreign exchange.

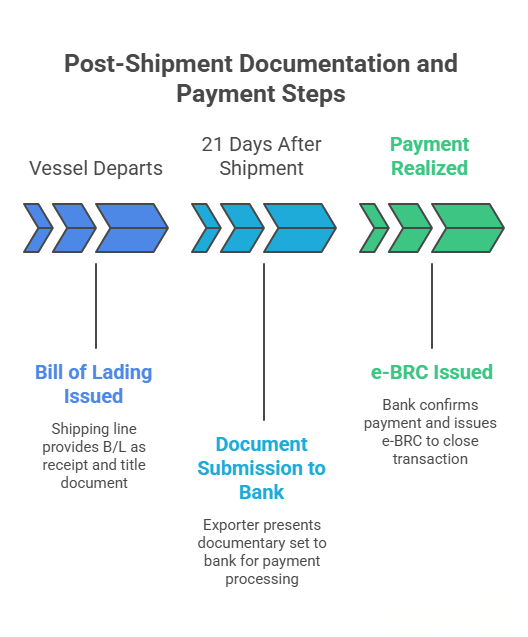

16. Obtaining the Bill of Lading (B/L)

Once the vessel departs, the shipping line issues the Bill of Lading. This is arguably the most important piece of export documentation. It acts as:

- A receipt for the goods shipped.

- A contract of carriage.

- The Document of Title: Whoever holds the original B/L legally owns the goods.

- Note: For air shipments, this is called an Airway Bill (AWB).

17. Submission of Documents to the Bank

To get paid, you must present a “documentary set” to your bank within 21 days of shipment. This set usually includes:

- The Bill of Lading.

- Commercial Invoice & Packing List.

- Certificate of Origin.

- Foreign Exchange Declaration Form. The bank then sends these to the buyer’s bank to “realize” the payment (under Letter of Credit or DP/DA terms). Once the payment arrives, the bank issues a e-BRC (Electronic Bank Realization Certificate), which officially closes the transaction in the eyes of the RBI and DGFT.

Conclusion:

The steps of export procedure may seem like a daunting mountain to climb for a beginner. However, when broken down into these 17 clear stages, the logistics workflow becomes a manageable business process.

The secret to a successful export business in India is not just knowing the steps, but having the right partners at Step 14 (Customs) and Step 15 (Shipping). At Samruddhii Global ( Navkar logistics pvt Ltd. CHA No. 11/473), we specialize in simplifying the most complex parts of this journey, allowing you to focus on finding buyers while we handle the technicalities of the port and customs.